Quarterly Board Report – September 26, 2025

The FFLA Board of Directors held its quarterly board meeting on September 26, 2025, in Miami, Fla. The University of Miami School of Law hosted the meeting. Ashley Sybesma presided over the meeting, and grantee presentations were given by Karen Ladis, Executive Director, Dade Legal Aid, and Monica Vigues-Pitan, Executive Director, Legal Services of Greater Miami. FFLA is appreciative of the accommodations provided and coordinated by Dean Marni Lennon, and the informative and impactful presentations from the grantees. FFLA also appreciates the 28 grantee representatives who attended the board meeting in person and via Zoom.

The major actions of the board and reports received during the meeting included:

IOTA Implementation Policy and Guidelines, effective August 20, 2025

At its June 26 meeting, the Board approved the proposed IOTA Implementation Policy and Guidelines on first reading, returned it to the work group for second reading and final drafting, and directed the work group to submit the resulting document to the Executive Committee for review and consideration of final approval. Thereafter, the work group reviewed the document, made minor revisions and presented it to the Executive Committee for review and consideration. A motion was made and seconded to approve the IOTA Implementation Policy and Guidelines on second reading, thereby finalizing the document for immediate implementation. The motion passed unanimously. This action was approved by the Board in its consent agenda for the September 26 meeting.

The IOTA Implementation Policy and Guidelines is the result of last year’s annual review process for the IOTA Rule Implementation Work Plan. Having completed its task, the work group suggested that the group remain engaged to review the IOTA Work Plan which was initially passed in 2022 as a result of the Court’s 2021 amendments to the IOTA rule. A six-person work group met several times over a six-month period to review the existing document for general updates, grammatical refinements and stylistic enhancements. To ensure a thorough evaluation, four subgroups were established to review each of the Work Plan’s main sections: Background, Objective Standards, Fair Distribution Plan, and Compliance and Reporting.

The key changes to the document are:

- Background

- The Work Plan has been converted into an Implementation Policy and Guidelines document.

- FFLA’s current mission statement has been incorporated.

- Budget duties and compliance responsibilities under the IOTA rule have been clearly articulated for both FFLA and its grantees.

- Objective Standards

- The required years of demonstrated successful experience in providing qualified legal services for grantee organization applicants have been reduced from five to three.

- The document reiterates FFLA’s commitment to expanding its grantee network to include a greater number of providers.

- Language in the Prohibited Area (g) section has been updated to reflect guidance provided by the Review Committee in response to a grantee inquiry.

- The term “Single Source audits” has been updated to “Use of IOTA Funds Audits” for greater clarity. Additionally, the submission requirements have been modified from 90 days after the end of each grant period involving IOTA funds to June 30 for all IOTA funds received and spent in the preceding calendar year.

- A reminder that grantees’ independent audited financial statements must be submitted within 120 days after the end of their fiscal year.

- The Fair Distribution Plan

- Revised language to further articulate FFLA’s primary funding objective for IOTA collections, as well as the means available to achieve it.

- Timeline and distribution processes for grants and awards containing IOTA collections are clarified to maximize compliance with the IOTA Rule.

- Pro Bono Support & Enhancement Grants may, but are not required, to be determined on a case-by-case basis through an application process.

- Provides that Disaster Relief grants—classified as periodic grants for limited purposes—may be awarded differently depending on exigent circumstances.

- Compliance and Reporting

- Updates and clarifies FFLA’s responsibilities for the separate IOTA audit per section (g)(10) of the IOTA Rule.

- Reporting and certification dates have been updated for consistency with preceding sections.

- Other

- Outdated exhibits have been removed, and a new Exhibit B (Evaluation of Grantee Performance: Basic Checklist) has been added.

A copy of the IOTA Implementation Policy and Guidelines is on FFLA’s website and is available upon request.

IOTA Grants to be recalibrated to coincide with calendar year grant periods.

In its consent agenda, the Board approved the Executive Committee’s decision to adopt staff’s recommendation to conform all grants funded by IOTA collections to coincide with calendar year grant periods. The process will start with Pro Bono Support and Enhancement grants, followed by Children’s Legal Services grants, with the new Elder Law Grants Program implemented in time for CY 2027 grants. This will streamline applications, reports, and IOTA compliance audits thereby reducing workloads and administrative burdens on both FFLA and its grantees. It will also result in better and more consistent reporting for all involved.

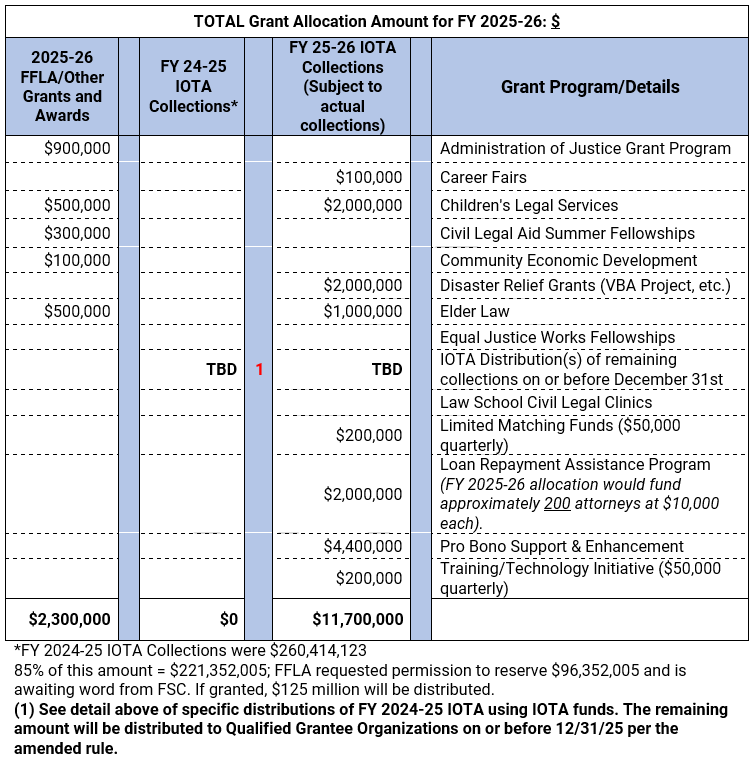

FY 2025-26 Grant Allocation Approved

Grants Committee Chair Maria Gonzalez brought forth the committee’s recommendations which were contingent upon the outcome of FFLA’s pending petition to the Florida Supreme Court to allow FFLA to distribute a total of $125,000,000 in IOTA collections and place in reserves for the grantees $96,352,005.

Mr. MacKenzie then provided an overview of the process FFLA undergoes to determine the total amount of funds potentially available for distribution to its grantees. After the presentation and an opportunity for discussion and questions, the Board approved the grants allocation as reflected in the chart below.

This recommendation:

- Allocates $2,300,000 to fund designated grant programs with other collections;

- Allocates $11,700,000 to fund designated grant programs with IOTA collections received in FY 25-26 contingent on need and availability of existing FY 24-25 IOTA collections; and

- Defers final allocation of FY 24-25 IOTA collections until FFLA receives word from the Florida Supreme Court regarding FFLA’s request for reserve.

Report of the Investment Committee

Director Joe Kadow, chair, reported on the Investment Committee’s numerous activities which have resulted in a busy year for the Committee and FFLA’s investment advisor. Mr. Kadow provided a brief overview of FFLA’s investment portfolio which is available for review upon request. He then presented the Investment Committee’s submission for consideration and approval of proposed amendments to FFLA’s Master Investment Policy. The amendments were passed on second and final reading at the committee’s last meeting and were recommended for final approval by the Board. The amendments primarily address the creation of the IOTA Grantee Reserve Account (IOTA Grantee Reserve) and the FFLA Operations Reserve Fund (Operations Reserve). The amendments also update the existing Master Investment Policy Statement. After discussion, the committee’s recommendation was approved by the Board unanimously. FFLA’s Master Investment Policy Statement, effective as of September 26, 2025, is available for review upon request.

Mr. Kadow also reported that the work group assigned to study potential investments with more Florida banks met and decided to table its work until further notice and as circumstances warrant. It is understood that any action taken by FFLA regarding expansion of its business dealings with financial institutions will be accomplished through an RFP process with notice to all qualified financial institutions.

Lastly, Mr. Kadow reported that the Investment Committee has spent considerable time analyzing FFLA’s investment vehicles, investment managers, and investment manager performance. Consequently, the committee at its September 10 meeting tabled potential portfolio changes while it continues its review regarding the selection of particular investment vehicles and managers. It expects to complete its work and make a final recommendation concerning the exact allocation amongst investment vehicles in time for the Board’s December 2025 meeting.

Mr. MacKenzie thanked all of the committee’s members for an extraordinary effort during the past two years addressing a myriad of important issues and for the hard work and considered recommendations and guidance provided by the committee.

NEXT MEETING

The Board’s next scheduled meeting will be on December 12, 2025, in Tampa.