An Organization You Can Trust

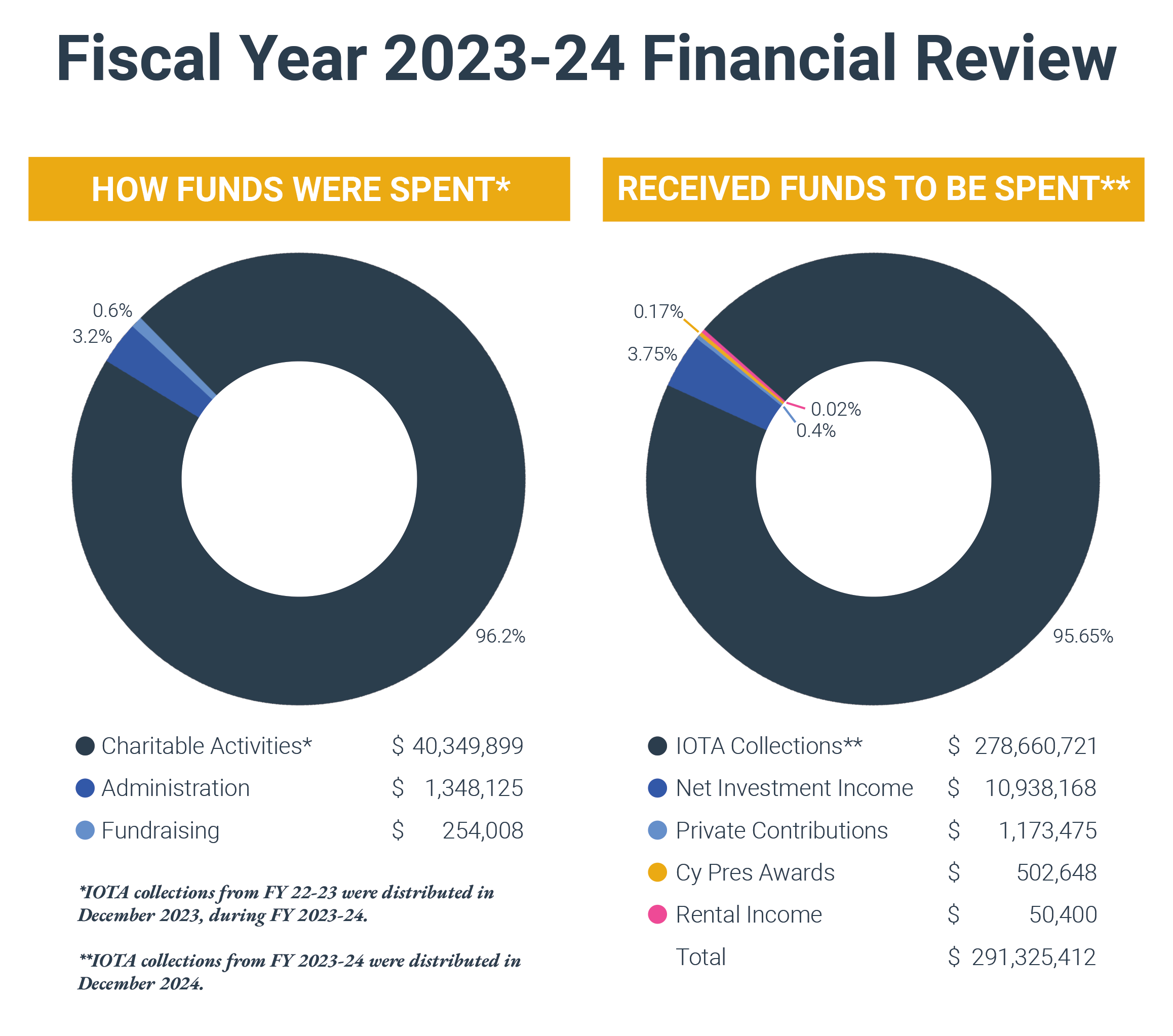

In 2023-24, FFLA spent 96.2% of its total expenses on charitable activities. Administration expenses represented 3.2% of total expenses, and fundraising expenses were 0.6%. We awarded more than $40M in grants. For more information, read our 2023-24 Annual Report.

- Fiscal Year 2023-24

- Financial Documents

- Financial Dashboard Archive

- IOTA Program

Financial Documents

- Consolidated Financial Statements of The Florida Bar Foundation and The Florida Bar Foundation Endowment Trust for the year ended June 30, 2024

- The consolidated financial statements are presented for convenience and information purposes only and should not be relied upon. A copy of the printed consolidated financial statements can be provided upon request.

- The Florida Bar Foundation FY 2023-24 IRS Form 990

- The Florida Bar Foundation Endowment Trust FY 2023-24 IRS Form 990

- 2023-24 Annual Report

Quarterly Financial Dashboard Archive

Financial Dashboard through Sept. 30, 2025

Financial Dashboard through June 30, 2025

Financial Dashboard through March 31, 2025

Financial Dashboard through December 31, 2024

Financial Dashboard through September 30, 2024

Financial Dashboard through June 30, 2024

Financial Dashboard through April 30, 2024

Financial Dashboard through January 31, 2024

Financial Dashboard through October, 31, 2023

Financial Dashboard through July 31, 2023

Financial Dashboard through April 30, 2023

Financial Dashboard through January 31, 2023

Financial Dashboard through October 31, 2022

Financial Dashboard through July 31, 2022

Financial Dashboard through April 30, 2022

Financial Dashboard through January 31, 2022

Financial Dashboard through October 31, 2021

Financial Dashboard through July 31, 2021

Florida’s Interest on Trust Accounts (IOTA) Program

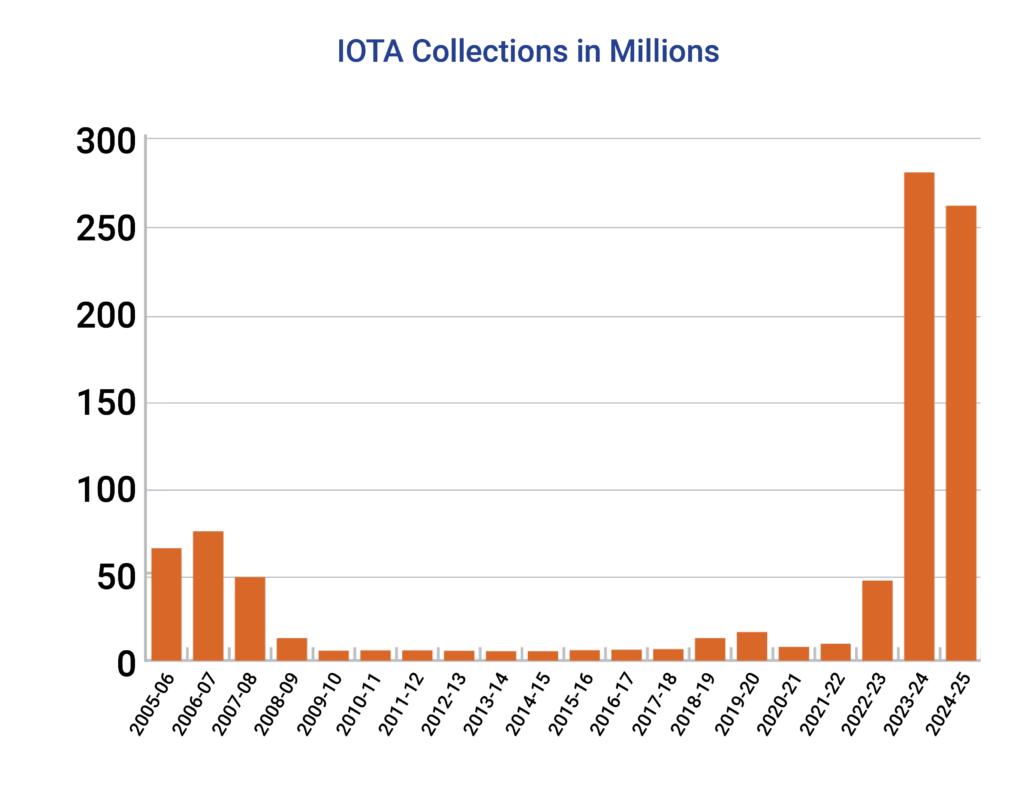

IOTA collections directly correlate with interest rates, which are driven by the U.S. Federal Reserve’s “federal funds rate.” A decade-long global recession beginning in 2008 resulted in the U.S. Federal Reserve holding the federal funds rate near zero until 2017, when it began to increase. The COVID-19 pandemic resulted in a sudden decrease in the federal funds rate back down to nearly zero, followed by a sudden increase to levels not seen since 2007. In May of 2023, an amendment to Rule 5-1.1(g), Rules Regulating The Florida Bar took effect, requiring financial institutions that voluntarily participate in Florida’s IOTA program to pay interest on IOTA accounts based on The Wall Street Journal Prime Interest Rate. This has resulted in more consistency, predictability, and a meaningful increase in funds available for civil legal aid programs.

Investments

FFLA funds are invested by professional investment managers under policies approved by the board of directors. The investment policies are developed with assistance from outside consultants who also work with FFLA’s investment committee and board to evaluate investment managers’ performance.

Thank Your Banker

September 1981 marked implementation by the Florida Supreme Court of the country’s first IOTA Program and the beginning of an important source of support for civil legal assistance to the poor– projects to improve Florida’s justice system and programs to promote public service by law students. While we often mark that milestone and thank those responsible, we don’t publicly recognize often enough Florida’s banking community. IOTA works because of the support and cooperation of Florida banks, from the superb bank staff who make sure monthly remittance information and interest gets to FFLA, to the teams who worked so closely with FFLA to implement the interest rate comparability rule, to the leaders of the Florida Bankers Association who step up to the plate and help IOTA achieve its full potential. FFLA, its grantees and those they serve are very grateful for the successful partnership between the legal and banking communities that is Florida’s IOTA Program.